Anglo African Investments Ltd and its subsidiaries (the “Group”) have achieved a satisfactory performance during the year under review, achieving double-digit growth in revenue and profit from continuing operations, despite the difficulties encountered in its regional business.

The transformation plan disclosed in the IR2016 was implemented during FY2017, the highlights of which are as follows:

Revenue from continuing operations grew by 24% from MUR 220.7 million in FY2016 to MUR 272.6 million in FY2017, driven by:

On the other hand, revenue from international business, excluding from Zambia, fell in this transition year as we contracted our local presence in Zimbabwe, Madagascar, and Rwanda.

Hence, the Group’s information technology business and telecom consultancy remain the drivers for the Group’s performance despite the difficult economic environment. Group profit after tax from continuing operations increased by 27.1% to reach MUR 13.7 million.

The Group’s profit for the year showed a flat growth considering that profit from discontinued operations in FY2017 included results of only 6 months operations till disposal date, compared to 12 months last year.

Gross margin from continuing operations fell from 29% in FY2016 to 27% in FY2017 while net margin from continuing operations was maintained at 5% in both periods.

Administrative and other expenses attributable to continuing operations were well controlled and increased by 3% to MUR 58 million in FY2017.

The Company’s borrowings, relating to obligations under finance lease, represented less than 5% of equity in both FY2017 and FY2016.

The Group has sufficient liquidity to fund its operations. It generated cash from operating activities of MUR 37.3 million in FY2017 and its current assets ratio is 2.3.

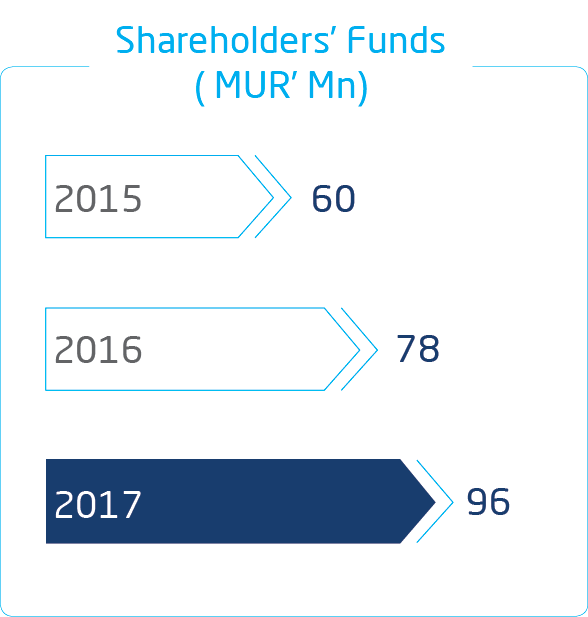

In line with its policy not to declare dividend till 30 June 2017, no dividend has been paid out for FY2017. This policy was adopted in order to strengthen the capital base of the Group and have sufficient free cash flow to fund its growth.