A Board and Committee evaluation and director’s individual evaluation questionnaire was circulated to the directors in September 2017. This evaluation showed mainly that the Board functioned well, but most importantly provided recommendations where improvements could be brought in its functioning. These will be implemented as from the second quarter of FY2018. The detailed score of the Directors’ Evaluation exercise is shown in the following table.

| Score | |

|---|---|

| Functions of the Board | 86% |

| Size, Composition and Independence of the Board | 88% |

| Board meetings and Chairman’s appraisal | 92% |

| Board committees | 91% |

| Audit & Risk Management Committee (ARMC) | 88% |

| Corporate Governance, Remuneration & Nomination Committee (CGRNC) | 87% |

| Director’s individual assessment/evaluation | 91% |

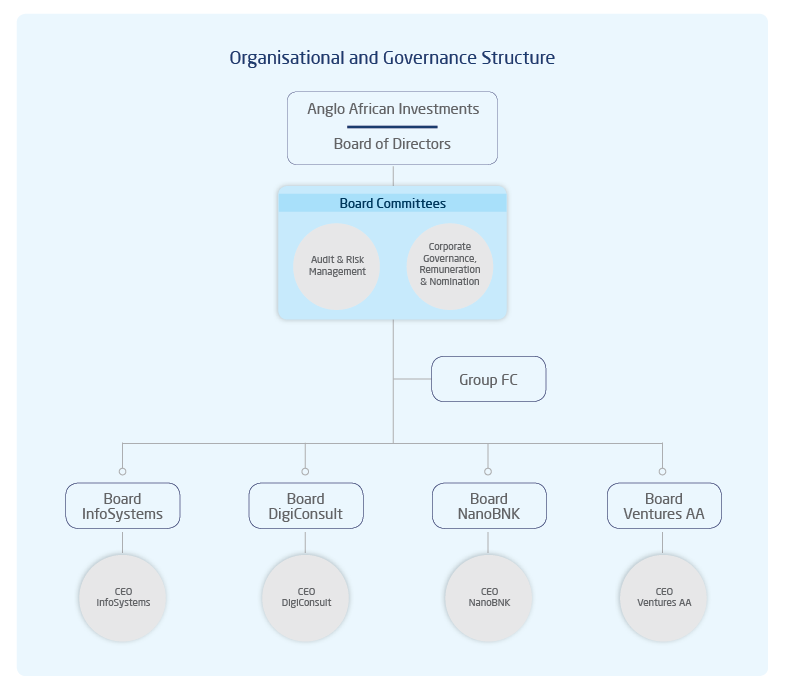

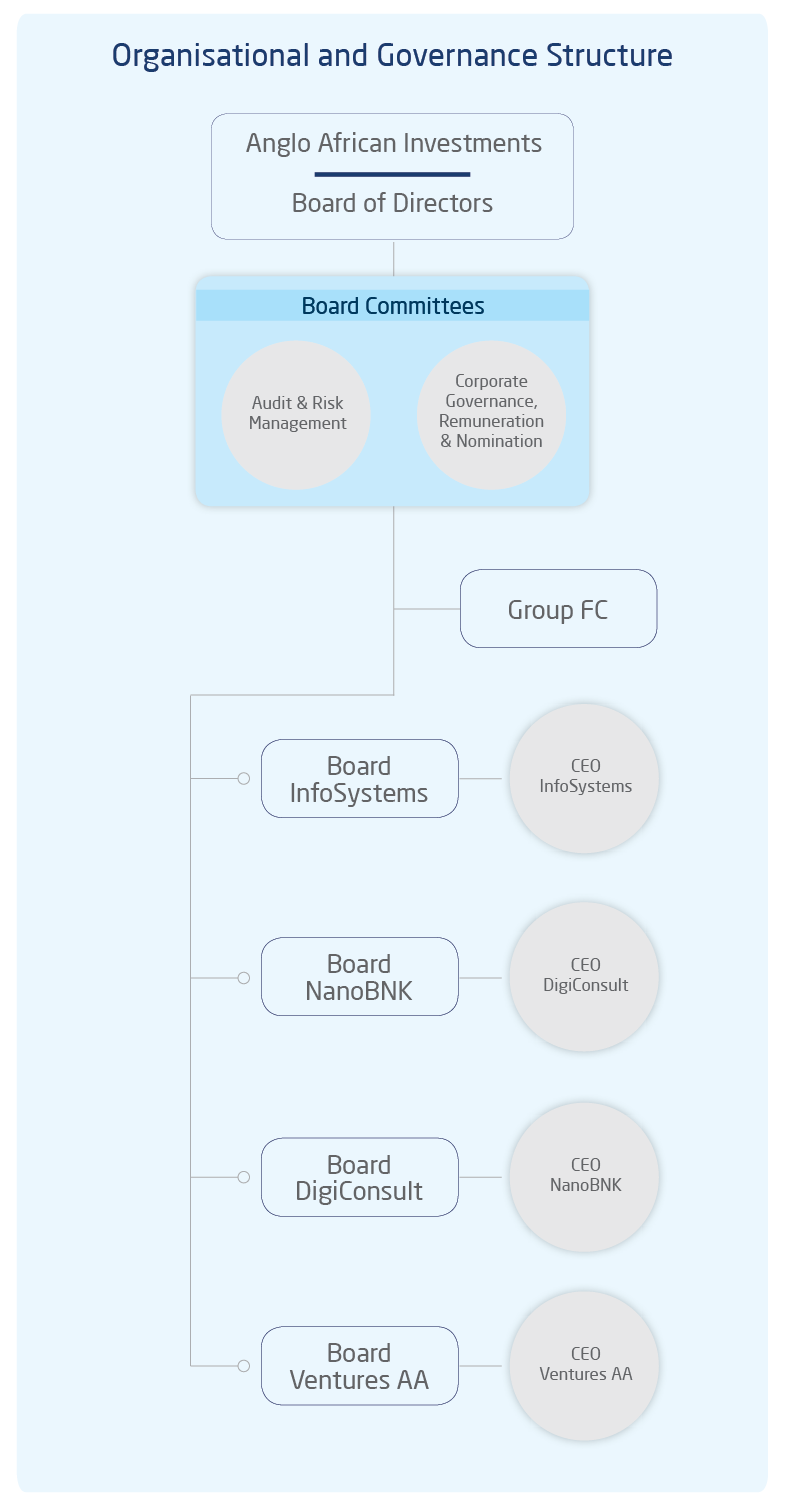

The Group operates within a clearly defined governance framework that allows the Board to balance its role of providing risk oversight and strategic counsel while ensuring adherence to regulatory requirements and risk tolerance. The Board has set up two Board committees, namely the Corporate Governance, Remuneration and Nomination Committee, and the Audit and Risk Management Committee, with clearly defined mandates.

The Board committees facilitate the discharge of the Board’s responsibilities and provide in-depth focus on specific areas. The committees report to the Board through their respective chairman and minutes of all committee meetings are submitted to the Board. Each committee has its Terms of Reference (ToRs), which the Board reviews at least once a year. The ToRs for each committee set out its role, responsibilities, scope of authority, composition and procedures.

The main objectives of this Committee are to

At 30 June 2017, the members of the Committee were Mr Sunil Banymandhub (chairman of the committee), Mr Guillaume Ortscheit and Ms Sanjana Singaravelloo.

The main objectives of this Committee are to:

At 30 June 2017, the members of the Committee were Mr Jean-Claude Béga (chairman of the committee), Prof. Marc Kitten and Mr Sanjeev Manrakhan.

| Board Meetings | Corporate Governance, Remuneration and Nomination Commitee | Audit and Risk Management Commitee | Remuneration MUR | |

|---|---|---|---|---|

| Jean-Claude Béga | 4/4 | 1/1 | n/a | 160,000 |

| Sunil Banymandhub | 3/4 | n/a | 1/1 | 100,000 |

| Ali Jamaloodeen | 4/4 | n/a | n/a | 1,286,475 |

| Marc Kitten | 4/4 | 1/1 | n/a | 120,000 |

| Sanjeev Manrakhan | 4/4 | 1/1 | n/a | 1,170,000 |

| Guillaume Ortscheit | 4/4 | n/a | 1/1 | 120,000 |

| Sanjana Singaravelloo | 3/4 | n/a | 1/1 | 95,000 |

The policy of the Group is to appoint the Chief Executive Officer of the subsidiary and at least one director from the holding company on the board of the subsidiaries.

The profile of the Management Team and Senior Executive can be seen for each company:

The Group is committed to abide by the highest standards of ethical and professional integrity, based on a fundamental belief that business should be carried out honestly, fairly and legally. Our Code of Conduct, which encompasses our ethical practices, anti-bribery rules, data protection and confidentiality norms amongst others, is intimated to employees upon joining as part of their employment conditions.

The Company takes any allegations of solicitation of bribes or any corrupt practices very seriously. As such, any of these allegations are escalated directly to the CEO who will then decide, based on recommendations from the internal executive committee and external (Legal advisor) counsel, whether to refer it to the disciplinary committee and eventually relevant enforcement authorities.

The directors and staff are encouraged to selfdeclare conflicts of interest and if applicable, withdraw from the decision-making process.

The Board and management team are responsible for managing conflict of interest situations in order to ensure that the workplace behaviour and decision-making throughout the Group are not influenced by conflicting interests. Policies regarding gifts and hospitality offered have been communicated to staff.

Related party transactions are disclosed in Note 22 to the financial statements.

The fees payable to the external auditors for audit services amounted to MUR 359,000 (2016: MUR 536,279). No fees were paid to them for non-audit services.

There was no contract of significance subsisting during the year to which the Company or any of its subsidiaries was a party to and on which a director was materially interested either directly or indirectly.

As from January 2016, on the recommendation of the Corporate Governance, Remuneration and Nomination committee, non-executive directors are paid a fee for attending Board meetings and Committee meetings. The Chairman of the Board and Chairman of the Committees are paid a higher fee. Executive directors are in full-time employment of the Group and do not receive additional fees for sitting on the Board or the Committee meetings.

The remuneration policy for management and staff is to reward effort and merit as fairly as possible. Other factors considered include experience, qualifications, skills scarcity, responsibilities shouldered and employee engagement. The Chief Executive Officer of each subsidiary is also incentivised through a profit sharing scheme based on the profitability of the subsidiary and the achievement of set key performance indicators (KPIs).

The Group contributed MUR 448,364 from its CSR fund to 3 NGOs focused on helping underprivileged and vulnerable children across Mauritius, namely

(i) Century Welfare Association

(ii) Child Evangelism Fellowship and

(iii) Adolescent Non Formal Education Network (ANFEN).

The Group has not made any other donations during the year (2016: nil).

The Group has issued a Workplace Safety Rules handbook that is provided to all staff. The handbook is regularly updated. The Group is committed to:

Anglo African Investments Ltd is a private company limited by shares. The share capital of the Company consists of 1,000 ordinary shares of MUR 100 each and is wholly held by Mr Sanjeev Manrakhan. There has been no dealing in the shares of the Company during the period under review.

The dividend policy was to not pay out any dividend until 30th June 2017. This policy will be reviewed thereafter.

The Board is responsible for the system of internal control and risk management. Management is responsible for the design, implementation and monitoring of the internal control systems. In view of the size of its operations, the Group did not have an internal audit department.

Under Section 166(d) of the Companies Act 2001

We certify, to the best of our knowledge and belief, that the company has lodged with the Registrar of Companies for the year ended 30 June 2017 all such returns as are required under the Companies Act 2001.

(Section 75(3) of the Financial Reporting Act)

Name of Public Interest Entity (PIE): Anglo African Investments Ltd

Reporting Period: 1st July 2016 to 30th June 2017

We, the directors of Anglo African Investments Ltd, confirm that to the best of our knowledge, the Company has complied with all its obligations and requirements under the Code of Corporate Governance

As the Board of Anglo African Investments Ltd, we acknowledge our responsibility for ensuring the integrity of our Integrated Report 2017.

Together with management, we applied our collective mind to the preparation and presentation of information in this report and are of the opinion that our Integrated Report is presented, in all material aspects, in accordance with the International Framework.